-

Company

8+ Years Experience20+ Countries Served1000+ Satisfied Client1000+ Products Delivered

-

Services

8+ Years Experience20+ Countries Served1000+ Satisfied Client1000+ Products Delivered

- On Demand Solutions

- Hire Developers

- Work

-

Resources

-

Grocery Delivery Apps Saudi Arabia

-

Top Food Delivery Apps in UAE

-

Top Medicine Delivery Apps

-

Top Food Ordering Apps in Qatar

-

Top Carwash Apps

-

Top Online Shopping Apps

-

Top Live Cricket Streaming Apps

-

Top apps like Dave

-

Top Police Drone Detector Apps

-

Top Apps Like Onlyfans

-

Top Live Football Streaming Apps

-

Top Free Video Editing Apps

-

Top Event Management Apps

-

Top Grocery Delivery Apps in Kuwait

-

Top Healthcare Apps in Qatar

-

Top Using Mobile Apps in Israel

8+ Years Experience20+ Countries Served1000+ Satisfied Client1000+ Products Delivered -

- Pricing

- Blog

- Contact Us

On Demand Solutions

- OTT App

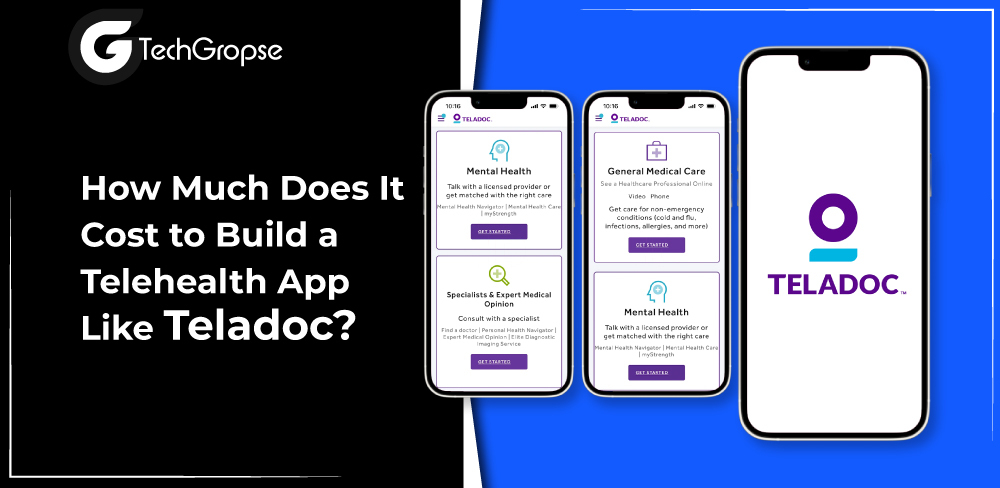

- Healthcare App

- Marijuana App

- Grocery Delivery App

- Ecommerce App

- E-Learing App

- Medicine Delivery App

- Online Food Delivery

- Taxi Booking App

- Fitness App

- Realestate App

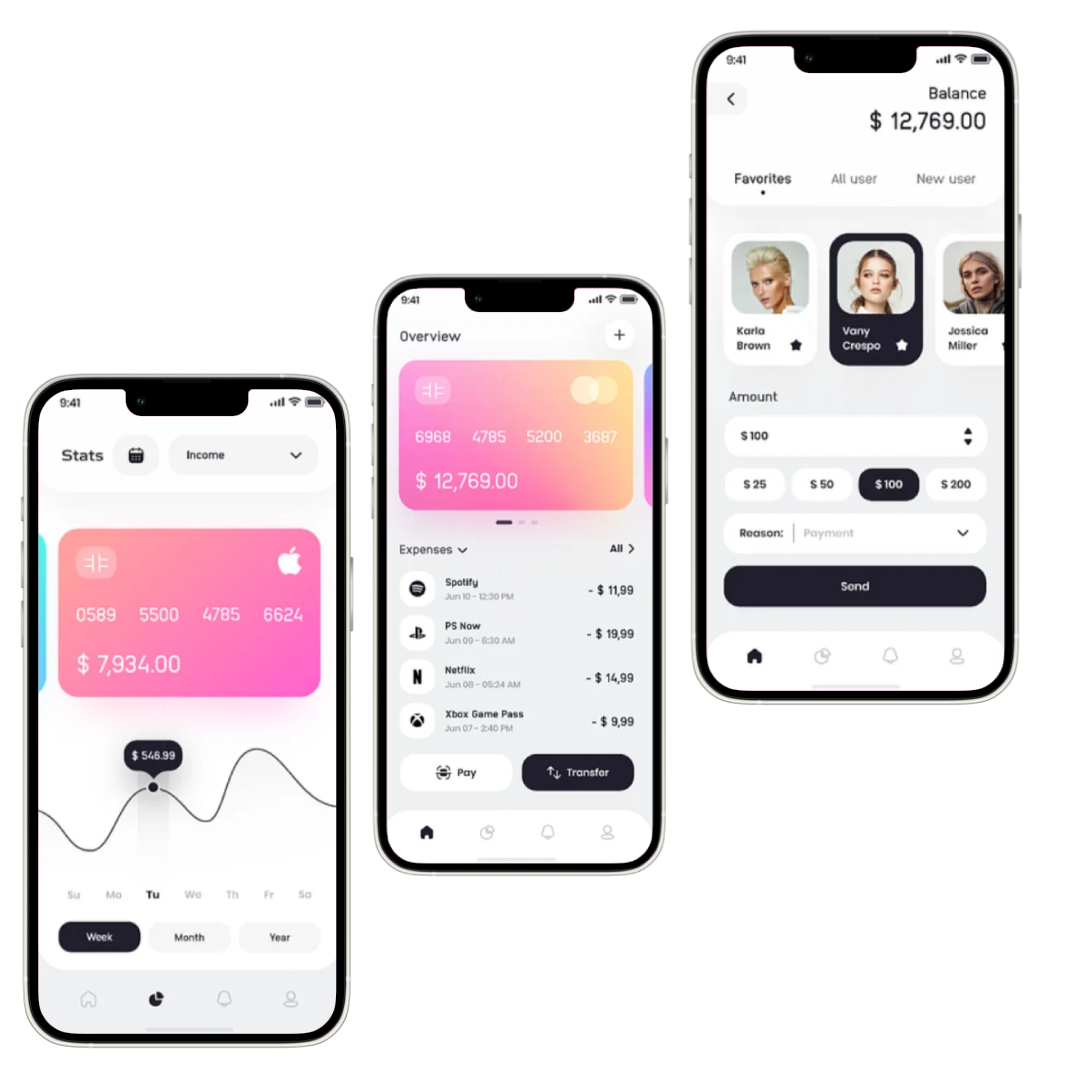

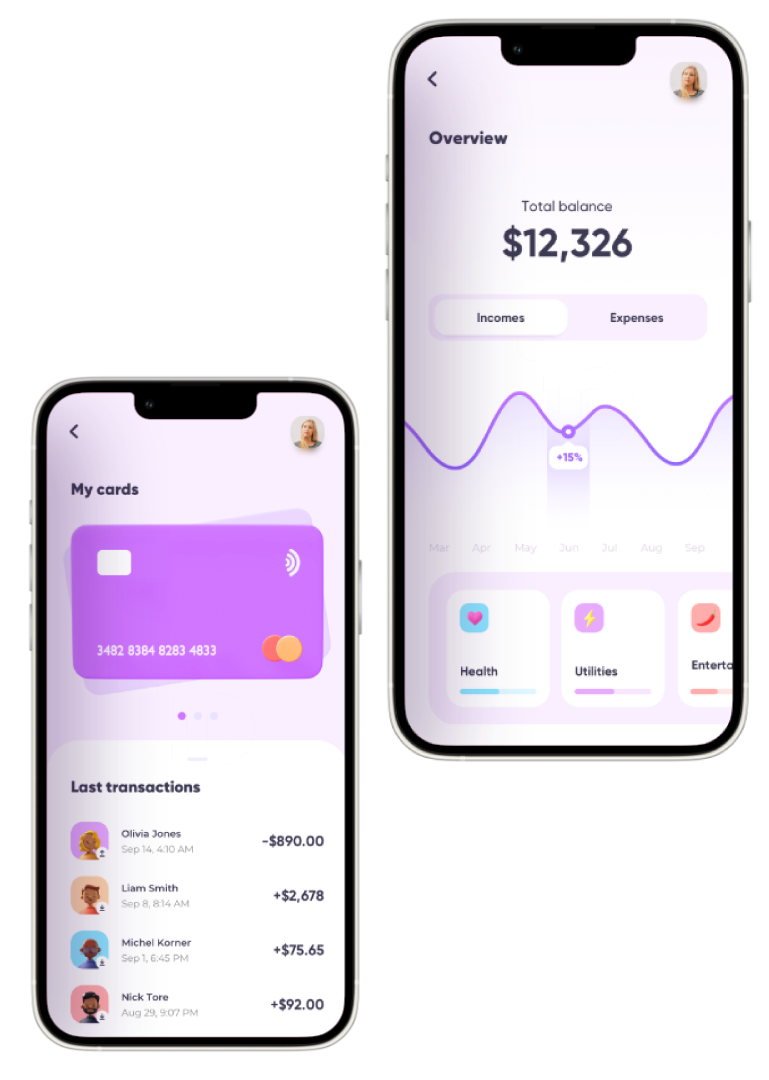

- Ewallet App

- Car Wash App

- Dating App

- Handyman App

- On-Demand App

- Zillow Like App

- Onlyfans Like App

- E Scooter App

- Live Cricket Score App

- Live Video Shopping App

- HR Management Software Development

- Logistic App Development

- mhealth App Development Company

- Fintech App Development Company

Hire Developers

- Hire Mobile App Developers

- Hire IPhone App Developers

- Hire Android App Developers

- Hire Flutter App Developers

- Hire React Js Developers

- Hire React Native Developers

- Hire Game Developers

- Hire Php Developers

- Hire Node Js Developers

- Hire Vue Js Developers

- Hire Golang Developers

- Hire Dedicated Developers

- Hire Angular JS Developers

- Hire Python Developers

- Hire Blockchain Developers

- Hire Laravel Developers

- Hire AEM Developers

- Hire Indian Developers

Resources

Trending platforms

- Grocery Delivery Apps Saudi Arabia

- Top Food Delivery Apps in UAE

- Top Medicine Delivery Apps

- Top Food Ordering Apps in Qatar

- Top Carwash Apps

- Top Online Shopping Apps

- Top Live Cricket Streaming Apps

- Top apps like Dave

- Top Police Drone Detector Apps

- Top Apps Like Onlyfans

- Top Live Football Streaming Apps

- Top Free Video Editing Apps

- Top Event Management Apps

- Top Grocery Delivery Apps in Kuwait

- Top Healthcare Apps in Qatar

- Top Using Mobile Apps in Israel